Community

– that’s all you need to know

Bya StaffWriter

n Indian-American

owner and managing

partner of a hedge

fund fromWashington

D.C. pled guilty Feb. 1

to obstructing justice in an

investigation into his business

activities by the U.S. Securities

and Exchange Commission.

Vineet Kalucha, 51, pled

guilty in the U.S. District Court

for the District of Columbia. His

sentencing is scheduled for June

six, U.S. Attorney Channing D.

Phillips said.

The charge carries a statutory

maximum of five years in prison

and potential financial penal-

ties. Under the sentencing

guidelines, the parties have

agreed that Kalucha faces a like-

ly range of 10 to 16 months in

prison and a potential fine of

$3,000 to $30,000.

George Palathinkal of

Singapore and a business part-

ner of Kalucha, pled guilty in

March 2015 to a federal charge

of perjury. He is awaiting sen-

tencing.

According to the govern-

ment’s evidence, Kalucha

formed Aphelion Fund

Management LLC in 2012 and

was its majority owner, partner

and chief investment officer.

Palathinkal was the general part-

ner and chief financial officer.

The company served as the

investment adviser and general

partner for two unregistered

hedge funds.

In 2013, according to the gov-

ernment’s evidence, Kalucha,

Palathinkal, and Aphelion

Management began soliciting

new investors for the Aphelion

Funds. Kalucha subsequently

provided potential investors

with marketing materials for

Aphelion Management, using

“inaccurate performance statis-

tics”.

Among other things, Kalucha

altered a report prepared by an

accounting firm hired by

Aphelion Management to review

prior investment performance

and “caused this report” to be

sent to prospective investors.

The accounting firm became

aware of the misrepresentations

and demanded that Kalucha

cease distributing the altered

report and that he provide

notice to those who received it.

Kalucha incorrectly told the firm

that only one copy of the altered

report had been distributed.

The U.S. Securities and

Exchange Commission began an

investigation of Aphelion

Management in January 2014,

including an investigation into

the propriety and reasonable-

ness of payments from Aphelion

Management to Kalucha.

Kalucha provided investigative

testimony before the SEC on

Feb. 25, 2014.

Among other things, he testi-

fied that he had entered into a

written promissory note for

“about $350,000” with Aphelion

Management.

Kalucha later told Palathinkal

that he had testified before the

SEC that there were written

promissory notes covering loans

that the two of them had pur-

portedly taken from Aphelion

Management.

“Knowing that these notes

did not exist, Kalucha told

Palathinkal that he would have

Aphelion Management’s outside

counsel prepare such written

loan documents,” according to a

press note quoting the US

Attorney.

Kalucha and Palathinkal later

signed two such documents,

both said to be promissory

notes. Although these docu-

ments were actually signed in

early March 2014, they were

dated January 1, 2013. Kalucha

and Palathinkal provided these

documents to the SEC.

D.C. Hedge Fund Owner Pleads Guilty To

Obstructing Justice In SEC Investigation

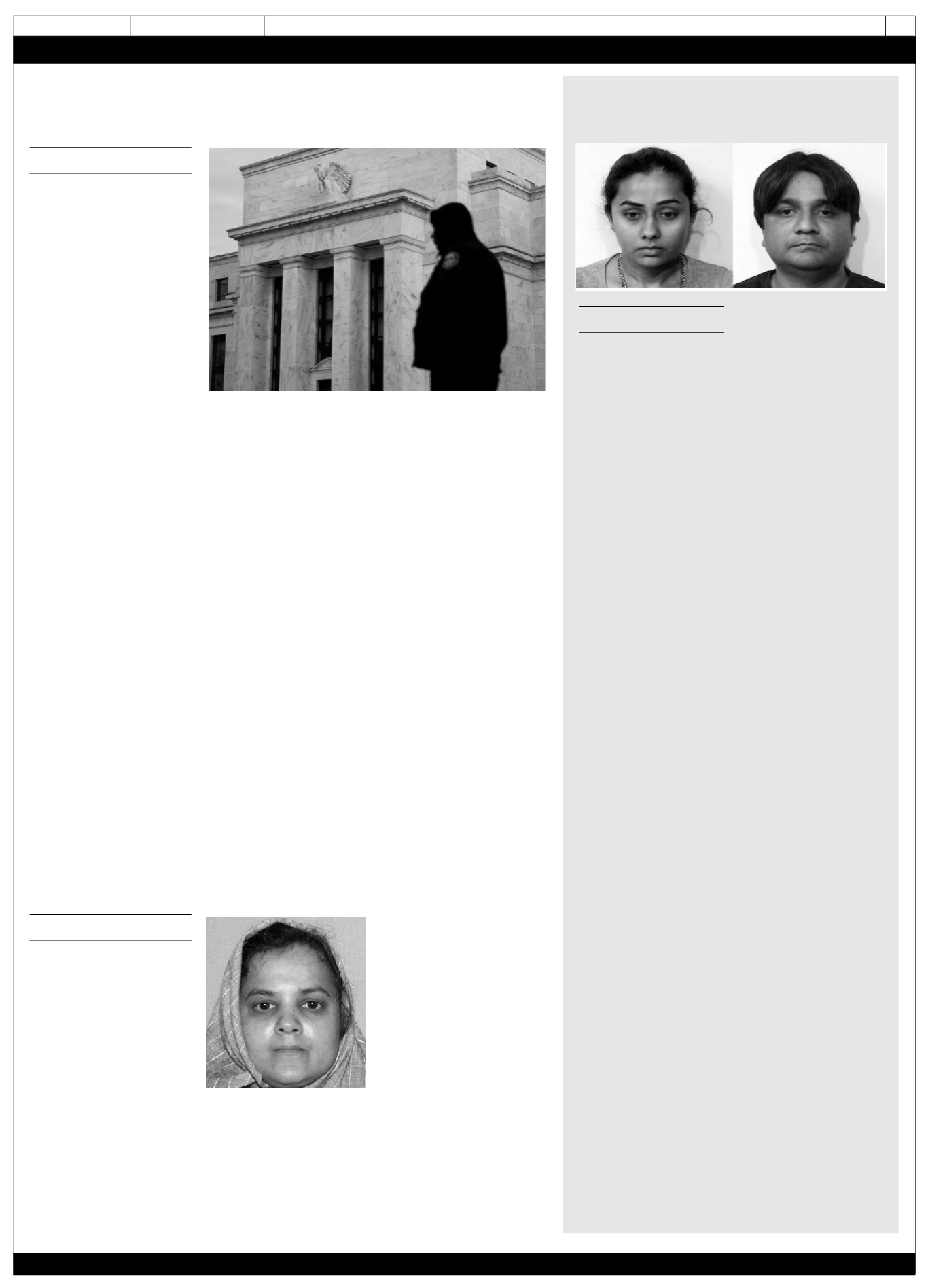

FromNews Dispatches

T

asneem Diwan, a 45 year-

old woman from East

Windsor, New Jersey, was

charged last week with alleged

murder of her 73-year-old moth-

er-in-law on Jan. 26.

The elderly woman, accord-

ing to autopsy reports quoted by

WPVI TV of Philadelphia, was

killed by blunt force trauma to

the head. Her body was found

on the evening of Jan. 26 in her

home on Mozart Court in East

Windsor, New Jersey.

Reports did not say the possi-

ble motive for the murder.

Tasneem Diwan was seen late

Jan. 29 in the bus terminal area

of the Tropicana casino in

Atlantic City, New Jersey where

she was detained by security

officers and Atlantic City police.

She was transported back to

Windsor for investigation by

Mercer County Homicide Task

Force.

Dr. Nauman Diwan, the vic-

tim’s son and the woman’s hus-

band, is a local internist, reports

said. ABC Action News quoted

neighbor Dan McDonough as

saying that he knew that they

are a nice family although he did

not themmuch. Sources told

ABC Action News that Tasneem

Diwan suffers frommental

health issues, something her

neighbors said they were

unaware of.

“Nothing that I saw that

made me think they are any-

thing but a nice, normal

American family living here in

the suburbs,” McDonough was

quoted as saying.

Diwan is charged with one

count of murder, one count of

possession of a weapon for an

unlawful purpose and one count

of unlawful possession of a

weapon.

Reports said Diwan’s bail was

set at $1 million. At press time

no court date has been sched-

uled.

Windsor Woman Charged

With Mother-in-law’s Murder

Bya StaffWriter

A

New Jersey woman

from India, who was

part of a network that

collected money from

unsuspecting people fooled

into believing they owed the

IRS back taxes, was sen-

tenced to three years proba-

tion by a New Jersey superior

court judge last week for

fraudulently netting thou-

sands of dollars from the vic-

tims and money laundering.

Nikita Natvarlal Patel, 25,

will likely be deported for

her role in the IRS scam,

according to North

Jersey.com that reported the

sentencing Jan. 29 by

Superior Court Judge Susan

J. Steele. At least 70 people in

32 states were defrauded by

the scam.

The judge ordered Patel,

who is in the U.S. on an

expired visa, to serve three

years’ probation. Patel

worked as a “runner,” pick-

ing up money sent by people

who thought they owed

money to the IRS back taxes

because of phone calls from

India masquerading as IRS

officials.

Assistant Bergen County

Prosecutor Brian Lynch said

Patel, who acted as a “run-

ner’, meaning that she

picked up money from vic-

tims, would take a cut for

herself and then send the

rest to India from where the

fraudulent phone calls origi-

nated.

Her attorney, Rajinderpal

Singh Sandher said she had

no prior criminal history and

was willing to cooperate with

any further investigation.

Desi Talk had earlier

reported that Patel was

arrested by police in Leonia,

New Jersey, in September

with another runner Akash S.

Patel. The two were not relat-

ed.

Police were tipped off to

the pair’s activities by a caller

from Kentucky, who said he

had been told he owed

$1,400 and that he should

send the money to a

MoneyGram account in the

name of Vincent Arora at a

CVS store in Leonia.

Over the course of the

next two days, Leonia police

said they discovered that

“Vincent Arora” was really

Akash Patel and that he had

made about 30 transactions

in the previous week at

MoneyGram locations across

the state. Police twice

tracked him to stores in

Watchung and Elizabeth, but

each time narrowly missed

him.

After the pickup in

Elizabeth, police there were

able to locate the suspect’s

car and follow it to another

CVS, this time in Union.

Police stopped the car, with

both Patels inside.

Leonia police then took

them into custody, police

said at the time.

The report said that

numerous receipts for

MoneyGram transactions

were found in the car, along

with $9,140. Police later

recovered $10,822 from

Nikita Patel’s apartment in

Iselin. About $150,000 was

also seized from six bank

accounts in the suspects’

names.

The Patels were originally

charged with conspiracy to

commit theft by deception, a

second-degree crime. Nikita

Patel later pleaded guilty to

third-degree money launder-

ing.

Akash Patel, 33, pleaded

guilty to a third-degree theft

charge in November. He was

also sentenced to probation,

according to court records.

Akash Patel, who is a citizen

of India, has since been

deported.

Leonia Police Chief

Thomas P. Rowe had earlier

said that many victims will

be able to recover the money

they lost. “In some

cases, the victims lost

their life savings,” Rowe ear-

lier said, adding that he did

not yet know the total

amount of money the Patels

were able to talk their vic-

tims into sending them, but

“we do know it is more than

we seized,” according to the

northjersey.com report.

A

New Jersey Woman In IRS Phone

Scam Sentenced To Probation

13

News India Times February 12, 2016